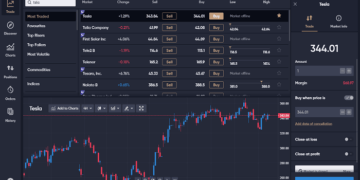

Bybit is a regulated cryptocurrency exchange that uses a multi-signature cold wallet system to protect your account from hacking or fraudulent activities. The team processes withdrawals manually three times a day. Bybit also uses a system known as Grey release update, which results in minimal downtime and continuous live trading access. The broker gets its index prices from three exchanges, Coinbase Pro, Kraken and Bitstamp. To ensure that it offers accurate prices, Bybit employs a team that manually processes withdrawals.

Baybit Broker In Trading

Some platforms require KYC authentication, while others do not. They all operate on a crypto-to-crypto basis. The fees charged by Bybit for trading are small compared to the fees you’ll incur when you trade with other brokerages.

The bybit platform also supports leverage trading. Leverage depends on the derivative contract you’re trading. For example, BTC/USD can be leveraged up to 100x. ETH/USD and XRP/USD can be leveraged up to 25x. The risk of using leverage should always be weighed carefully before deciding to trade with Bybit. There are a number of important things to know about the Bybit platform before signing up for a demo account.

Find The Best Crypto Pump And Dump Groups

Cryptocurrency pump and dump groups have made huge profits in recent months. They buy coins at a discount after a pump signal, promote them on social media, and fabricate fake celebrity tweets and news stories. Afterwards, they sell them for a profit. This strategy is very lucrative, but it can lead to losses as well. Pump and dump groups are notorious for causing market crashes and volatility in crypto.

Bitcoin pump and dump groups usually have a community of 200-to-two thousand members. They provide detailed instructions, market sentiment tools, time zone translations, and a method to determine a pump signal. Some groups even use images instead of text. And some are designed to counter bots. Some of these groups are even available on eToro. Regardless of which group you choose, be sure to use it responsibly.

To protect yourself from being ripped off, don’t invest in any the best cryptocurrency pump and dump groups. They’re not regulated, and most of the participants are retail traders. Institutional investors would prefer regulated markets, and pump and dump groups are no different. Therefore, be wary of scammers who ask for your money on message boards. Then, don’t fall for their bait! You’ll end up losing money. So how do you find the best cryptocurrency pump and dump groups? Their availability varies depending on where you register. While EUR and USD are universal, you’ll need to make sure to check the XM broker review for your region.

Final Thoughts

If you’re skeptical, look for a company that has a proven track record of preventing fraudulent schemes and redistributing fraudulent coins. In many cases, pump and dump groups use bots to buy and sell large quantities of coins. The reason why they use bots is because these programs are primarily designed to benefit their elite members. So if you’re skeptical, don’t be afraid to speak up. This type of fraud is illegal in most countries, but there are ways to protect yourself from it.